Your savings goal may be big or it may be small. Either way, it’s your goal. And the Select Savings Account can help you get there.

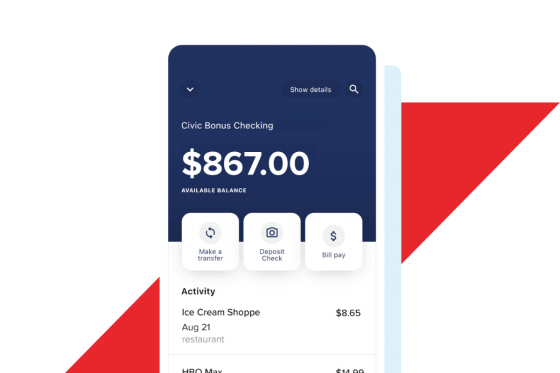

Bonus Checking Account

Get all the flexibility life demands

Civic has built-in features designed to meet your unique needs.

Early access and total control

The Bonus Checking Account is designed to move at the speed of your life. Get access to your direct deposits4 up to three days sooner using the early deposit feature. Use online or mobile banking4 to set up and organize your bills, deposit checks digitally, and link your debit card to your preferred mobile wallet.

Enjoy more benefits with the Bonus Checking Account:

- Get 0.50% APY1 with 20 debit card purchases.

- Use ATMs worldwide, with fees reimbursed2

- Pay just a $1 monthly maintenance fee when you open a new Bonus Checking account

Learn more with our You + Money blog post: How to earn money with a checking account.

Stay on track, spend better

Make progress toward your goals with real-time expense monitoring and financial wellness tips. You can even link accounts from other organizations for a 360° view of your complete spending history.

Want more security? Use the app to enable text alerts.4 We’ll notify you right away about any suspicious transactions. Overdraft protection5 is also available to help you handle any unplanned purchases and stay on track.

Here are a few frequently asked questions:

Disclaimer

1 APY = Annual Percentage Yield. Applies to member accounts incurring 20 debit card purchases per month, excluding ATM withdrawals and automatic account drafts. Purchases and/or transactions may take up to two business days from transaction date to post to the account. Upon qualifying, APY of 0.50% will be applied to your average daily account balance during the following month up to $10,000. Balances in excess of $10,000 will earn APY of 0.15%. Minimum opening deposit for the Civic Bonus Checking Account is $5. For members making less than 20 qualified purchases per month, APY is 0.15%. Rate is subject to change.

2 Civic participates in select surcharge-free ATM networks. You can find the current list of surcharge-free ATM locations at civicfcu.org/any-atm. Other ATM networks may charge an ATM fee that Civic will reimburse, up to a total of $20 per month, beginning on the first day of the month and ending on the last day. If you are eligible for an ATM fee reimbursement, funds are typically released by Civic to your account within two (2) business days, but timing may vary.

3 Message and data rates may apply. Items transmitted using remote check deposit are subject to verification and may not be covered under our Funds Availability Policy. This means amounts over $500 are not available for immediate withdrawal.

4 Message and data rates may apply.

5 Overdraft Transfer Service is available from Checking, Savings or Money Market accounts with no minimum increments or transfer fees. Members may also apply for an overdraft line of credit from which transfers are made in increments of $50 up to available limits.