Quicklinks

Top Results

2024 Annual Report

In 2024, we took a historic step forward, merging our two credit unions into one so that we can continue to serve members across the state in a new way. This transition means we’ll control our own destiny and be better prepared for the future. Committing to the financial well-being of our members starts with the assurance that we’re ready to serve them into tomorrow.

We’re stunned at all we

accomplished in 2024

We opened 11 branches in under a year, introduced a full line of traditional and new financial products, and doubled down on our commitment to partnerships for a stronger North Carolina. In between, we hit the road, visiting thousands of members, sharing our story.

We’ve come so far, but 2025 is no finish line. We’re just getting started.

Letter from our Board Chair

Ken Noland

Dear members,

Thank you for sharing in this historic time in the life of your credit union, as we approach Civic Day this June when we become an independent credit union! Your Board and management team have planned well and are completely prepared for this historic day, a day to honor our history and to celebrate our future.

Dwayne Naylor

CEO Report

To all members,

It is my privilege to share this 2024 CEO Report. The work of the past year, as the years before it, moved us closer to an exciting milestone in our 42-year credit union history: Civic Day is coming this June. It’s the day we become a completely independent credit union, ushering us into the future!

Impact Report

2024 was an amazing year for our credit unions. Never in our history have we done so much in such a short time.

Here are a few of the highlights:

- Developed or identified dozens of financial products and services for Civic members

- Created 11 Civic branches in under 12 months

- Combined two credit unions into one when Civic members voted to merge into LGFCU

- Worked in partnership with SECU as we readied our members for independence

- Supported and donated to hundreds of local government employees as they struggled to recover from Hurricane Helene

Board of Directors

Each Board Director is elected by and from among the credit union's membership. These men and women perform key audit and decision-making functions, set policies for the credit union, and appoint its CEO and members of the Supervisory and Loan Committees.

To read about the professional backgrounds of each Board Director, visit the Board of Directors page.

Ken Noland, Chair

Wilkesboro

David Dear, Vice Chair

Shelby

Jeanne Erwin, Treasurer

Cary

Ruth Barnes, Secretary

Atlantic Beach

Dr. Aaron Noble

Burlington

Lin Jones

Durham

Kellie Blue

Robeson County

Paul Miller

Snow Hill

Tony Brown

Halifax County

Supervisory Committee

The duty of this committee is to inspect the credit union's records for accuracy, its assets for security, and its procedures for the proper handling and use of funds.

Amy Bason

Raleigh

Ryan Draughn

Sanford

Emily Lucas

Wake Forest

Justin Merritt

Shelby

Shawn Purvis

Apex

Loan Review Committee

When members exercise their right to appeal a loan decision, this committee has the authority to review that decision and choose to uphold it or approve the loan.

Wilbert McAdoo

Efland

Jim Baker

Chapel Hill

Mike Eubank

Kill Devil Hills

Diana Harris

Cary

Nancy Held

Raleigh

Pam Hurdle

Hertford

Dale Johnson

Raleigh

Nancy Medlin

Garner

Charles Murray

Louisburg

Jean Stowers

Surf City

Sam Tingler

Holly Springs

Charles Weber

Washington State

Mark Williams

Wake Forest

Advisory Council

Our Advisory Council members are the volunteers who help shape our credit union. We would not be where we are today without their advocacy and assistance. We salute them and thank them for their many contributions.

Financial Report

By the numbers

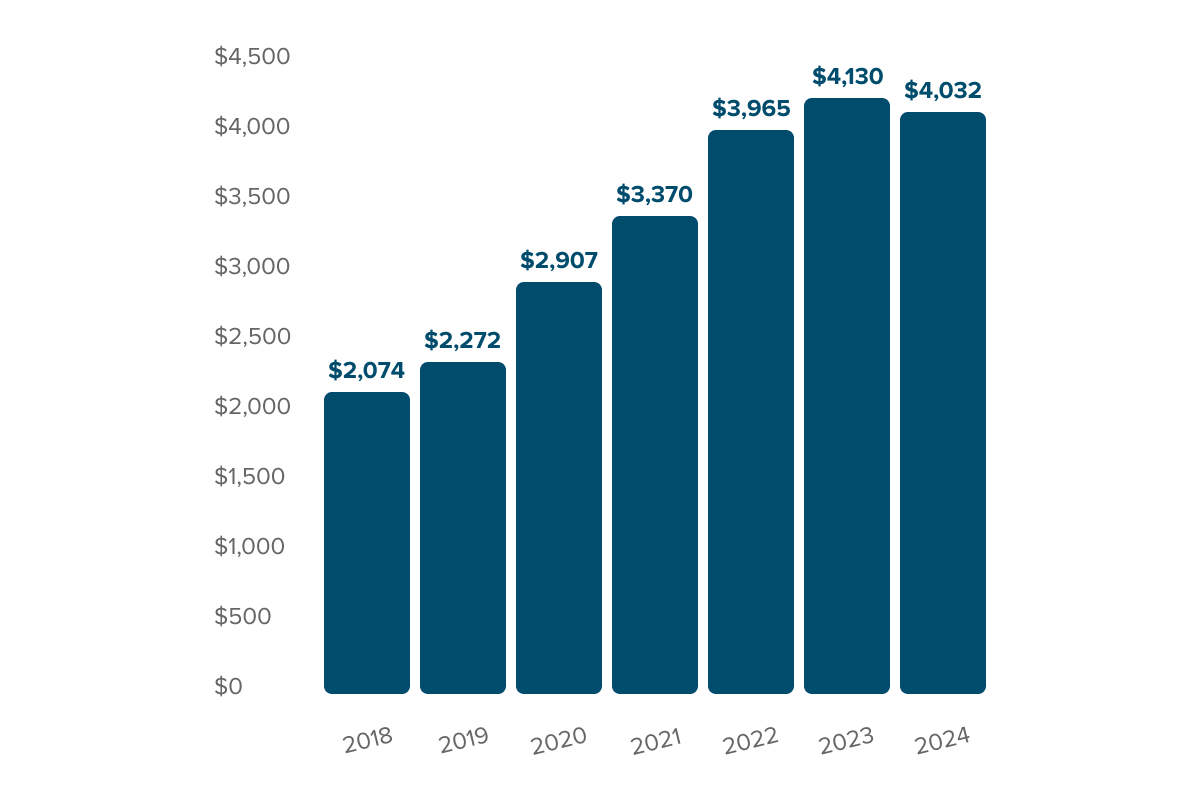

Asset growth

(in millions)

| 2018 | $2,074,000,000 |

| 2019 | $2,272,000,000 |

| 2020 | $2,907,000,000 |

| 2021 | $3,370,000,000 |

| 2022 | $3,965,000,000 |

| 2023 | $4,130,000,000 |

| 2024 | $4,032,000,000 |

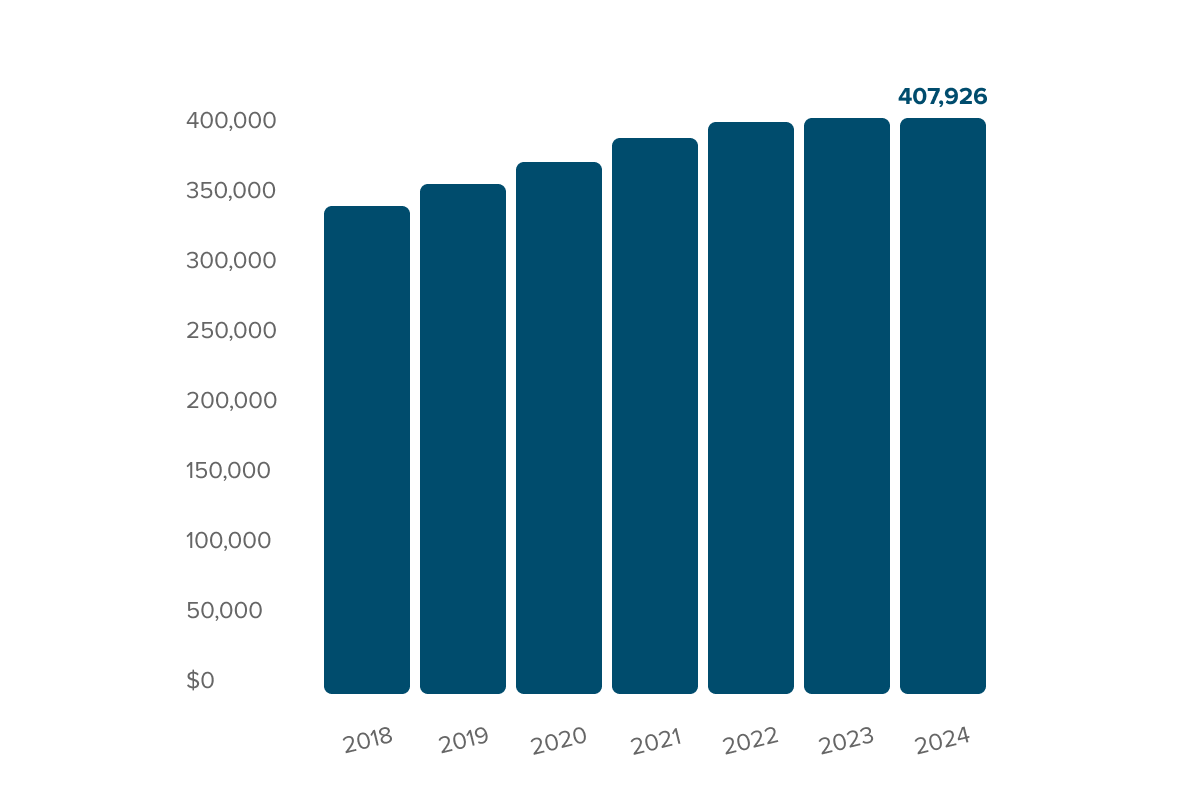

Membership growth

1% increase in membership 2023-2024

| 2018 | 339,835 |

| 2019 | 356,277 |

| 2020 | 370,521 |

| 2021 | 386,503 |

| 2022 | 399,221 |

| 2023 | 403,764 |

| 2024 | 407,842 |

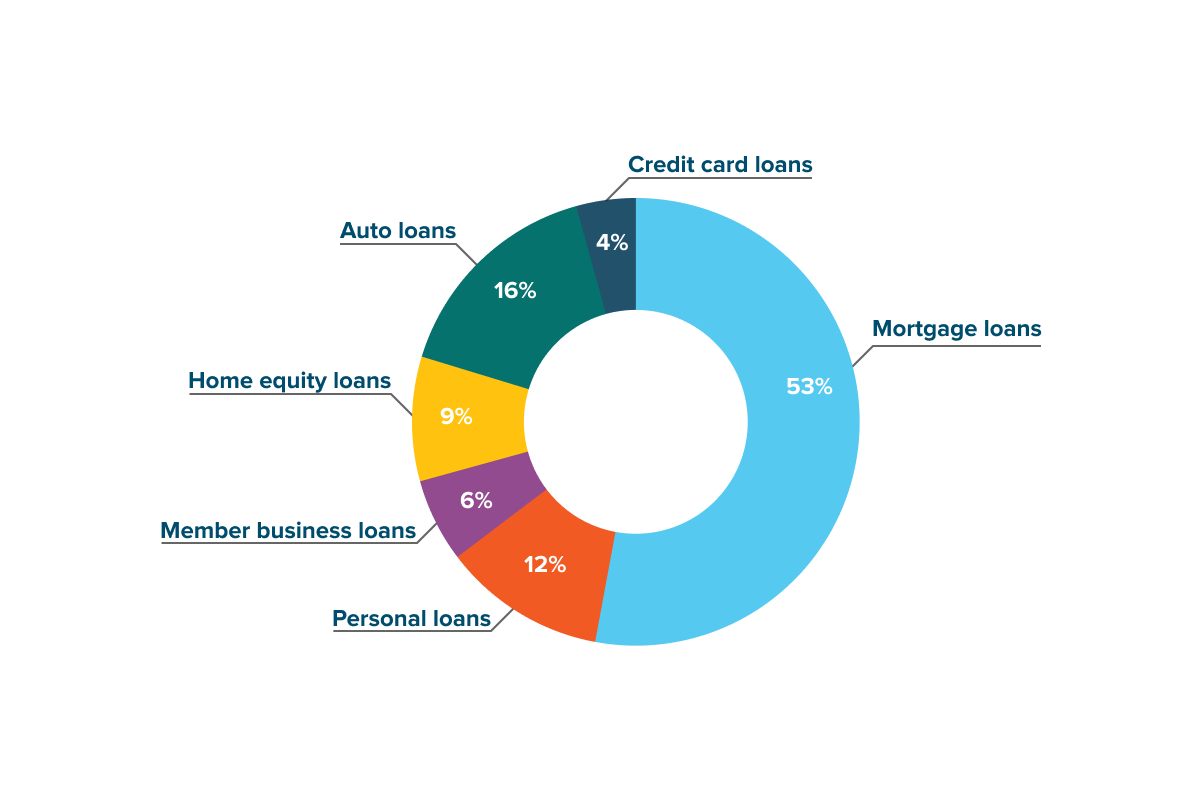

Loan portfolio mix

| Mortgage loans | 53% |

| Auto loans | 16% |

| Personal loans | 12% |

| Home equity loans | 9% |

| Member business loans | 6% |

| Credit card loans | 4% |

Investment portfolio mix

| Overnight funds and member capital | 64.46% |

| U.S. government agency securities | 29.92% |

| Federal Home Loan Bank Stock | 4.32% |

| Corporate CU capital | 1.30% |

Statements of Financial Condition

| 0 | Assets | 2024 | 2023 |

|---|---|---|---|

| 1 | Cash and Investments | $320,270,799 | $361,798,350 |

| 2 | Mortgage Loans | $1,877,088,030 | $1,992,887,643 |

| 3 | Personal Loans | $417,665,826 | $400,607,703 |

| 4 | Member Business Loans | $214,055,251 | $200,058,966 |

| 5 | Home Equity Loans | $318,873,374 | $272,256,524 |

| 6 | Auto Loans | $567,277,678 | $653,361,493 |

| 7 | Credit Card Loans | $152,619,062 | $153,418,540 |

| 8 | Allowance for Loan Losses | ($51,044,257) | ($65,233,528) |

| 9 | Net Loans | $3,496,534,965 | $3,607,357,341 |

| 10 | National Share Insurance | $33,747,490 | $31,178,532 |

| 11 | Other Assets | $181,644,692 | $129,642,925 |

| 12 | Total Assets | $4,032,197,946 | $4,129,977,148 |

| 0 | Liabilities & Equity | 2024 | 2023 |

|---|---|---|---|

| 1 | Payables | $126,784,823 | $416,917,165 |

| 2 | Share Accounts | $773,301,753 | $825,177,724 |

| 3 | Share Draft Accounts | $561,066,529 | $590,174,774 |

| 4 | Money Market Accounts | $841,952,629 | $851,525,499 |

| 5 | Individual Retirement Accounts | $184,355,242 | $213,051,779 |

| 6 | Share Certificates | $1,261,559,604 | $947,774,550 |

| 7 | Total Deposits | $3,622,235,756 | $3,427,704,325 |

| 8 | Total Reserves & Undivided Earnings | $283,177,367 | $285,355,658 |

| 9 | Total Liabilities & Equity | $4,032,197,946 | $4,129,977,148 |

Year to date as of 12/31/2024 and 12/31/2023.

Statements of Income

| 0 | Operating Income | 2024 | 2023 |

|---|---|---|---|

| 1 | Investment Income | $14,756,003 | $14,105,844 |

| 2 | Mortgage Loans | $76,294,345 | $79,630,936 |

| 3 | Personal Loans | $44,456,137 | $39,977,592 |

| 4 | Home Equity Loans | $21,687,988 | $12,385,448 |

| 5 | Auto Loans | $39,496,588 | $34,928,283 |

| 6 | Credit Card Loans | $21,041,946 | $20,279,360 |

| 7 | Member Business Loans | $7,241,599 | $6,378,697 |

| 8 | Total Loan Income | $210,218,603 | $193,580,316 |

| 9 | Other Operating Income | $62,596,757 | $57,697,241 |

| 10 | Total Income | $287,571,362 | $265,383,401 |

| 0 | Operating Expenses | 2024 | 2023 |

|---|---|---|---|

| 1 | Operating Expenses | $196,056,228 | $202,829,961 |

| 2 | Interest on Borrowed Funds | $9,984,211 | $24,591,247 |

| 3 | Share Accounts | $3,269,403 | $3,269,403 |

| 4 | Share Draft Accounts | $645,165 | $833,828 |

| 5 | Money Market Accounts | $16,157,933 | $18,513,137 |

| 6 | Individual Retirement Accounts | $4,399,025 | $4,828,519 |

| 7 | Share Certificates | $58,625,220 | $22,456,597 |

| 8 | Total Deposit Expense | $83,096,745 | $53,292,064 |

| 9 | Total Expenses | $289,137,185 | $280,713,273 |

| 10 | Net Operating Income | ($1,565,822) | ($15,329,872) |

Year to date as of 12/31/2024 and 12/31/2023.

Nature of operations

Local Government Federal Credit Union (the “Credit Union”) is a not-for-profit cooperative that serves employees of local government units. The Credit Union is organized under the laws of the Federal Credit Union Act and is exempt, by statute, from federal and state income and sales taxes. The Credit Union serves its members through the State Employees' Credit Union (SECU) network. This network includes more than 250 branches and more than 1,000 ATMs in all of North Carolina's 100 counties. Its subsidiary, Civic Federal Credit Union, serves members through Civic branches statewide and the nationwide CO-OP Shared Branch Network. The Credit Union's primary source of revenue is its loan portfolio.

Audited financial statements

The financial reports provided here have not been audited. You can review audited financial statements for the annual period ending June 30, 2023, from the Credit Union's accounting firm, CliftonLarsonAllen LLP, posted in the Audit Report section. These financial statements include a more in-depth financial analysis and extensive footnote disclosures that provide additional information on the results of the Credit Union for the respective period ends as noted above. Open and view this current Audit Report in a separate tab outside of this document.