Quicklinks

Top Results

Financial Health Tools

Get a snapshot of your financial situation with these in-app1 tools for saving, planning and budgeting, plus a credit score checker. Go ahead, be financially strong!

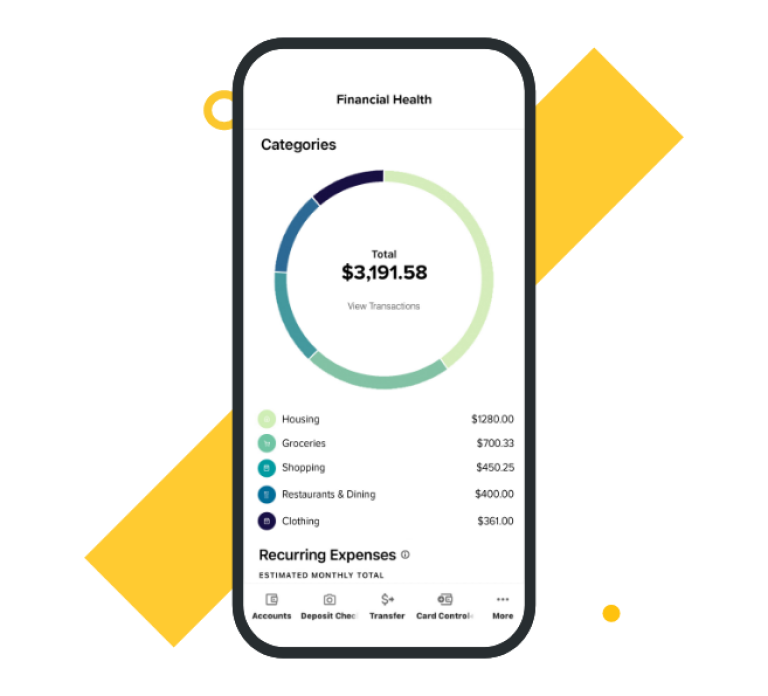

Be your own personal finance tracker

The numbers are the numbers. And seeing your spending habits each month can help you budget money. Make adjustments for a new savings goal, and always know if your spending plan is on track.

Reach your saving and budgeting goals with digital tools for financial wellness

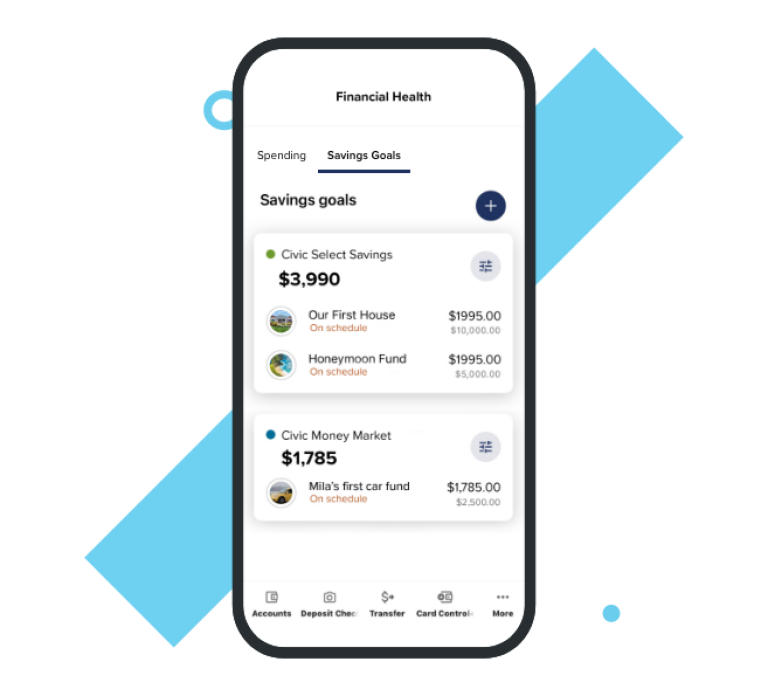

Get a clear line of sight to your financial goals and work toward them with the digital Savings Goal tool. Once your savings goals have names, it can be easier to work toward them and turn them into specific spending plans.

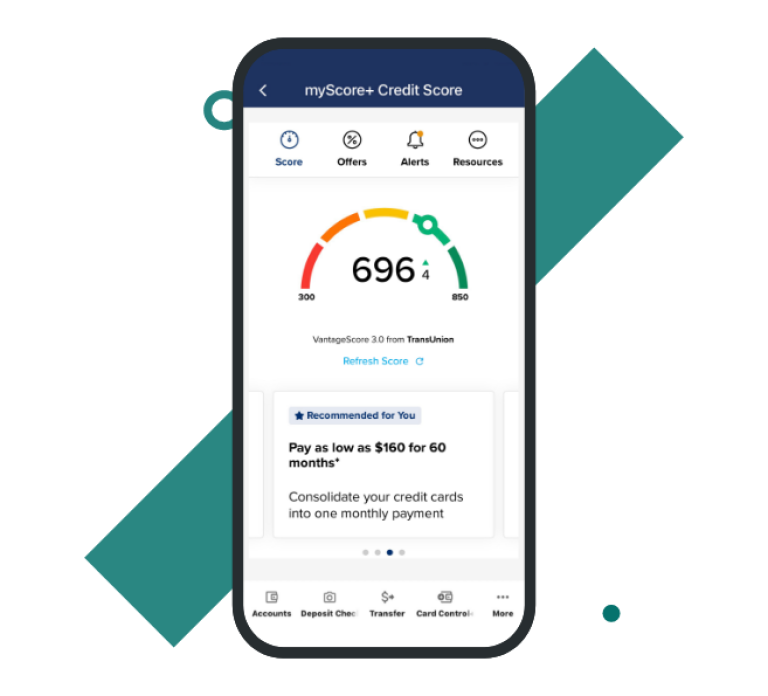

Monitor your credit score and check your progress, anytime

A good credit score can help you get approved for loans, credit cards, leases and more. MyScore+2 helps you understand your current credit score — and most important, shares what you can do to improve your credit score. Go ahead, be your own credit score checker.

See quick steps to make this happen

See quick steps to make this happen

Life is digital

So are these everyday financial tools

Here are a few FAQs

Are Financial Health tools available in the Civic app and online banking?

Yes, it is available in both.

How do I access the Financial Health tools in the Civic app and online banking?

In the Civic app, click “More” and click “Financial Health.” In online banking, it is located in the menu.

How do I view my spending data?

To view your spending data, click “Financial Health” and click “Spending Summary.”

How do I view my savings goals?

To view your savings goals, click ‘Financial Health” and click “Savings Goals”

How do I create a savings goals?

1. Click “Create a Savings Goal”

2. The Add Goal window will display.

3. Select an account to (a green checkmark will display next to the account).

4. Click the Next button

5. Select a category to set for the goal (a green checkmark will display next to the category).

6. Click the Next button.

7. Click the Goal Icon to add an image (optional).

8. Note: Photo upload is only available via desktop.

9. Enter the Goal Name (required).

10. Enter the Goal Amount (required).

11. Enter the Target Date (optional).

12. Click the Create Goal button.

13. A success message will display, indicating the goal has been successfully created.

How do I contact Civic if I have questions about my Financial Health section?

- Chat with us, weekdays 8 a.m. to 6 p.m. EST.

- Call us at 844.77CIVIC (844.772.4842), available 24/7, including holidays.

1 Message and data rates may apply.

2 The credit score provided is intended to help you understand the factors that affect your credit score and ways you may be able to save money with Civic Credit Union loan products. It is not used for loan approval purposes, or for determining loan rates. Loan rates and approvals are based on information provided to the credit union when you apply for a loan. The credit score found in the credit report may be different than the credit score you see. The offers presented are not offers to lend. Terms and conditions and offers are subject to change at any time.

Recommended articles

The ultimate resource for your banking needs