Quicklinks

Top Results

MyScore+

Get free credit score checks1 and recommended steps to help you improve, build and maintain good credit, all without any dings

Check credit score with myScore+

Your credit score is important for securing any type of lease or loan, getting additional credit cards, and more. myScore+ is a digital tool that checks your credit score for free, right from the Civic app.2 It shows you the ‘good’ and ‘negative’ areas of your credit habits and provides recommendations to improve. (We're cheering you on!)

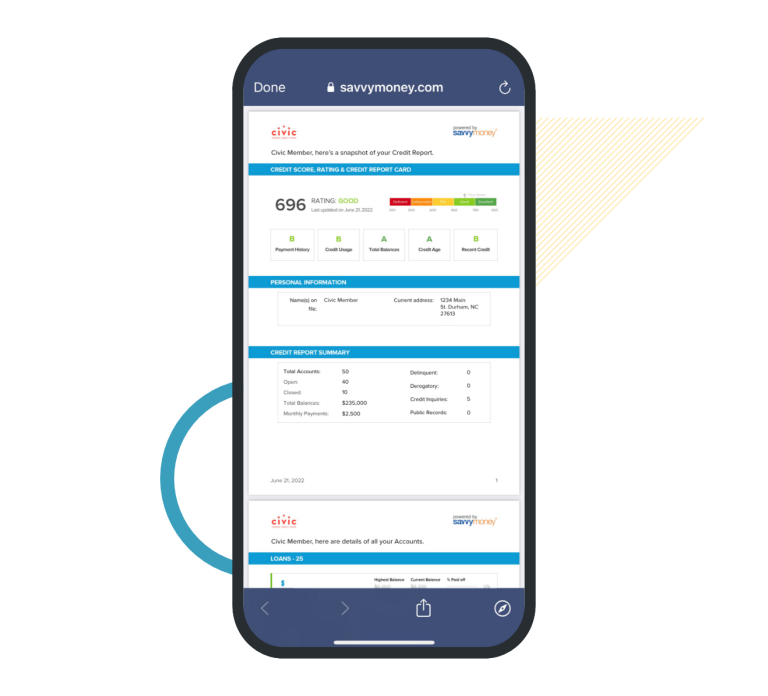

Get your complete credit report and credit score

Download your complete credit report to see your credit history, the types of credit accounts you have, and your payment history. Then, use the ‘Your Money’ tab in myScore+ to understand how your actions figure into a typical credit score calculation. Those actions may include payment history, credit usage, and more. See your credit score and understand what details lenders see — and why it matters.

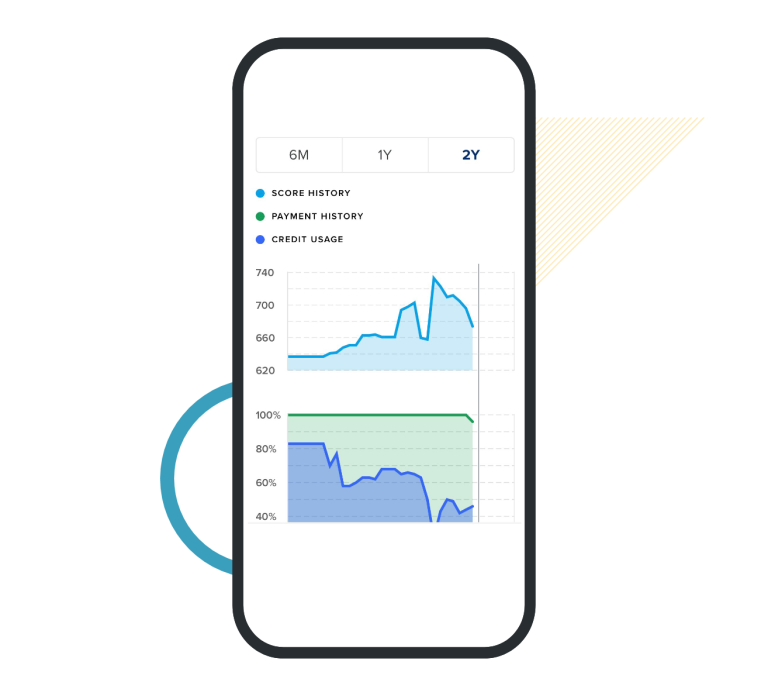

Monitor and check your credit score

Keeping track of your credit score progress matters. Check in with yourself about your credit score check. myScore+ has updates about credit score changes – up or down - so you can see the impact of your credit habits and make adjustments, if needed. Also, doing a free credit check on a regular basis can help you identify possible credit report errors or unauthorized credit inquires that may be attached to your credit.

See quick steps to make this happen

See quick steps to make this happen

Life is digital

So are these everyday financial tools

Here are a few FAQs

What is myScore+?

myScore+, powered by SavvyMoney®, is a comprehensive credit score program that instantly provides a comprehensive credit score analysis, full credit report, monitoring, credit alerts, and personalized offers—all in one dashboard. Not only can you access your most recent credit score and reports with no repercussions, but myScore+ helps you understand each factor that influences your credit score. This tool is available online and via mobile banking*, so with a swipe or two of your phone, you can start shaping your financial future to align with your goals.

Is myScore+ free?

Yes. myScore+ is entirely free and no credit card information is required to register.

Will accessing my credit score with myScore+ 'ping' my credit and potentially lower my credit score?

No. Checking your credit score with myScore+ is a “soft inquiry”, which does not affect your credit score. Lenders use ‘hard inquiries’ to make decisions about your credit worthiness when you apply for loans.

How often is my credit score updated?

If you are a regular online banking user, your credit score will be updated every month and displayed in your online banking screen. You can click (or tap) “refresh score” as frequently as every day by navigating to the detailed myScore+ site from within online banking.

How does myScore+ keep my financial information secure?

myScore+ uses high-level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party.

How does the myScore+ credit score differ from other credit scores?

myScore+ pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

Why do credit scores differ?

There are three major credit-reporting bureaus—Equifax, Experian and Transunion—and two scoring models—FICO or VantageScore—that determine credit scores. More than 200 factors in a credit report may be taken into account when calculating a score, and each scoring model may weigh credit factors differently, so no scoring model is completely identical.

Will Civic Federal Credit Union use the myScore+ credit score to make loan decisions?

No, Civic Federal Credit Union uses its own lending criteria for making loan decisions.

1 The credit score provided is intended to help you understand the factors that affect your credit score and ways you may be able to save money with Civic loan products. It is not used for loan approval purposes, or for determining loan rates. Loan rates and approvals are based on information provided to the credit union when you apply for a loan. The credit score found in the credit report may be different than the credit score you see. The offers presented are not offers to lend. Terms, conditions, and offers are subject to change.

2 Message and data rates may apply.

Recommended articles

The ultimate resource for your banking needs