Quicklinks

Top Results

Search Featured Block

Maximizing your NCUA share insurance

As a credit union member, you can trust that your deposits are federally insured up to $250,000 per account. From savings to checking to IRAs, saving more can mean making the most of that coverage.

What is NCUA share insurance?

The National Credit Union Administration (NCUA), an independent agency with the full backing and credit of the U.S. government, insures deposit accounts. This protects members against financial loss should a federally insured credit union fail, similar to how the FDIC protects the accounts of bank customers.

Not a single penny of insured savings has ever been lost by a member of a federally insured credit union!

Coverage limits for all your accounts

Your protected deposit accounts at Civic include Select Savings and Steady Save, Bonus Checking, Money Market, Choice Certificates, IRAs and Health Savings Accounts. Even YoungStar and NextGen youth accounts are protected, as are Civic business accounts!

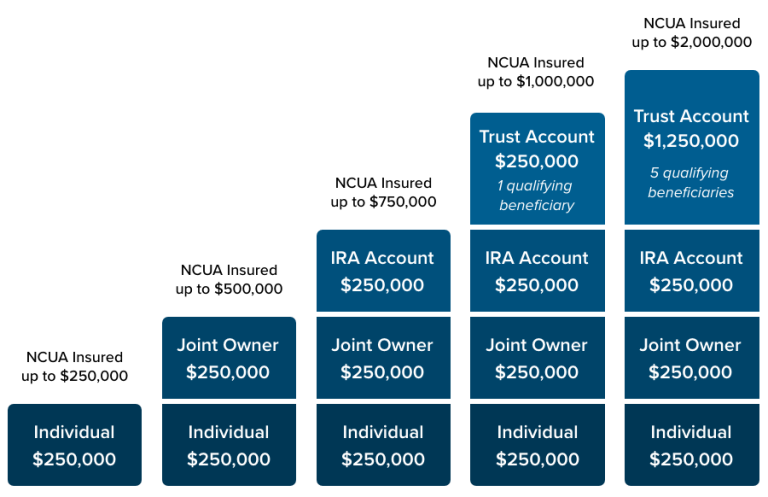

NCUA deposit insurance covers deposits of up to $250,000 in each member account separately, based on the ownership category of the account. But that does not mean you’re limited to $250,000 in deposits: If you have individual and joint accounts, or several types of credit union accounts, each one is insured at that level.

That means having joint accounts could boost your coverage! Use the NCUA Share Insurance Estimator to see your exact coverage, which will help you maximize your insured deposits.

Here’s what NCUA coverage can look like for some common account categories:

Helping you protect your money

Your money needs protection 24/7. Check out these tips to help you stay safe from account fraud or identity theft.

Here are a few FAQs

How can I be sure Civic is a federally insured credit union?

It’s easy! Search the NCUA’s online Credit Union Locator to verify our status. And like most credit unions, we display the official NCUA insurance sign in our advertising, where deposits are normally accepted (such as our branches, ATMs, etc.), and on our website. This insurance is required by law to protect members, and no credit union can end its federal insurance without first notifying members.

Is there a fee for share insurance coverage?

No, there are no charges or fees assessed to you for this coverage.

Which parts of my deposits are covered by NCUA share insurance?

Share insurance covers the balance of each of your deposit accounts, dollar-for-dollar up to the insurance limit, including your principal and posted dividends through the date of a credit union’s closure. But here’s an important point: Not a single penny of insured savings has ever been lost by a member of a federally insured credit union!

What’s not insured by NCUA? Money invested in stocks, bonds, mutual funds, life insurance policies, annuities or municipal securities.

1 Message and data rates may apply

Recommended Articles

The ultimate resource for your banking needs.