Top Results

Think big about your small business

A fresh perspective can help you find solutions to your small business challenges.

Better Business Banking

No more complicated products. Let’s keep things simple. Our approach is designed for you to spend less time worrying about financials and more time growing your business. Here’s what makes Civic different:

Free Structure

Your money should be working for you. We have worked to remove any unnecessary fees. Where fees do apply, they are clearly labeled for you.

Consultative Approach

You are not alone. New or veteran businesses can count on the same level of support from our teams. Have questions or need suggestions, we are ready to help.

Product Synergy

The more products or services you use, the more time and money you will save. These products all work together to give you a best-in-class business experience.

Need suggestions on where to start? We’ve matched popular solutions with different business stages. Explore the options below to

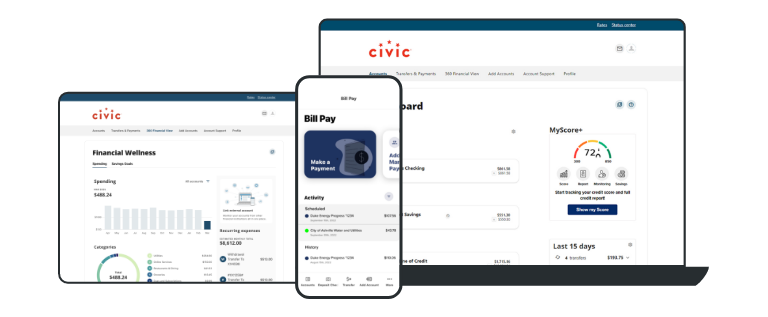

Hit the ground running

Having a foundational Business Checking and savings account is a vital step in managing your business cash flow. Dedicated business accounts allow for easier expense tracking and tax filing. The Civic Business Checking and Savings account get you access to business checks, bill pay and automated spending reports. Download the Civic app or register for online banking and you can manage your business anytime and from anywhere.

Getting started

Gearing up for growth

To pursue aggressive growth opportunities, you need diverse options. From operational accounts that allow for faster in-person, online and invoice payment mechanisms, to loan accounts that give you access to more capital, we have options designed to grow your business.

Advancing 2-5 years

Preparing for long term success

As your business grows, your needs change. Our business development team can work with you on custom solutions that address the full spectrum of your needs. We’ll work to provide your organization a cohesive 360o strategy that helps streamline your operation.

Maturing 5+ years

Is my business eligible?

During the account opening process, we’ll help you determine the eligibility method that works best for your business structure. Be sure to review the forms section for more information on business requirements.

We're here to help.

Recommended Articles

The ultimate resource for your banking needs.